Navigating the Compliance Landscape with Automation

Staying compliant is crucial, but manual processes are inefficient. This listicle presents eight leading compliance automation tools to simplify your compliance management. Discover how these tools help startups and enterprises alike address regulatory challenges, reduce risk, and streamline workflows. From Microsoft 365 Compliance Center to Resolver, explore solutions that fit your needs. This list provides a starting point for evaluating which compliance automation tools are right for your organization in the IN region.

1. Microsoft 365 Compliance Center

For organizations deeply entrenched in the Microsoft ecosystem, the Microsoft 365 Compliance Center stands out as a powerful compliance automation tool. This comprehensive, cloud-based platform helps manage regulatory requirements across various Microsoft services, offering unified compliance management, data governance, and risk assessment capabilities. It’s an invaluable asset for businesses seeking to streamline their compliance efforts, particularly those heavily reliant on Microsoft 365 tools. Its strength lies in its deep integration with the Microsoft suite, enabling seamless compliance management across familiar applications. This makes it a particularly compelling choice for businesses in India already leveraging Microsoft’s services, simplifying implementation and minimizing disruption to existing workflows.

The Microsoft 365 Compliance Center excels in addressing various compliance challenges. Its data loss prevention (DLP) capabilities extend across Office 365 applications like Exchange Online, SharePoint Online, and OneDrive for Business, preventing sensitive data leaks. For instance, a startup in the fintech space can use DLP to prevent the accidental sharing of customer financial data outside the organization. Similarly, an enterprise IT department can configure policies to block the transmission of confidential project blueprints. Compliance score and assessment tools provide a quantifiable measure of an organization’s compliance posture, offering actionable insights and recommendations. This is particularly helpful for businesses aiming to achieve certifications like ISO 27001 or comply with regulations like GDPR.

Advanced eDiscovery and legal hold functionalities simplify the process of identifying and preserving relevant data for legal proceedings. Information governance and retention policies automate data lifecycle management, ensuring data is retained and disposed of according to regulatory requirements. This feature is invaluable for heavily regulated sectors like healthcare and finance in India. Furthermore, insider risk management and communication compliance tools help mitigate risks associated with malicious or negligent insiders, safeguarding valuable intellectual property and maintaining a safe work environment.

One of the most compelling advantages of the Microsoft 365 Compliance Center is its seamless integration with the Microsoft 365 ecosystem. This tight integration allows for centralized compliance management across various services, minimizing administrative overhead and streamlining workflows. Built-in compliance templates for major regulations, such as GDPR, HIPAA, and PCI DSS, significantly reduce the time and effort required to configure compliance policies. Real-time compliance scoring and recommendations offer continuous feedback, helping organizations proactively address compliance gaps. The platform also boasts extensive data classification and labeling capabilities, enabling granular control over data access and protection.

While the Microsoft 365 Compliance Center offers a robust set of features, it’s important to be aware of its limitations. Its effectiveness diminishes significantly outside the Microsoft environment, making it less suitable for organizations relying on a diverse range of non-Microsoft platforms. The licensing structure can be complex, with multiple tiers and varying levels of functionality. Navigating this structure can be challenging, especially for startups and smaller businesses. Moreover, mastering the advanced features requires a steep learning curve, necessitating dedicated training and resources. Finally, it’s important to note that full functionality requires Microsoft 365 E3/E5 licenses, which can be a significant investment for some organizations.

For businesses deeply integrated with the Microsoft ecosystem, the benefits often outweigh the limitations. The Compliance Center offers a centralized platform for managing compliance across a wide array of Microsoft services, simplifying workflows and reducing administrative burden. However, organizations operating in multi-platform environments or those with limited budgets may find the licensing costs and learning curve challenging. It’s crucial to carefully assess your specific needs and environment before committing to this powerful, yet potentially complex, compliance automation tool. You can explore more on their official website: https://compliance.microsoft.com.

2. ServiceNow GRC (Governance, Risk & Compliance)

ServiceNow GRC is a robust, enterprise-grade platform designed to automate and streamline governance, risk, and compliance (GRC) processes. It offers a centralized system for managing risks, ensuring compliance with regulations, and automating workflows across the organization. This makes it a powerful compliance automation tool, particularly for larger organizations with complex compliance requirements. For businesses in the IN region navigating the evolving regulatory landscape, a comprehensive solution like ServiceNow GRC can be invaluable.

ServiceNow GRC provides end-to-end compliance automation, covering everything from policy and control management to risk assessment and audit management. This integrated approach allows organizations to move away from siloed processes and gain a holistic view of their GRC posture. For instance, a company operating in a highly regulated sector like finance can leverage ServiceNow GRC to automate the tracking and reporting of compliance with regulations such as KYC (Know Your Customer) and AML (Anti-Money Laundering).

Key Features and Benefits:

- Automated Compliance Monitoring and Reporting: ServiceNow GRC continuously monitors compliance posture and generates automated reports, enabling businesses to proactively identify and address potential violations. This feature reduces the manual effort involved in compliance reporting and allows for timely intervention.

- Risk Assessment and Management Workflows: The platform facilitates streamlined risk assessment workflows, enabling organizations to identify, assess, and mitigate risks effectively. Automated workflows ensure that risk responses are implemented promptly and consistently.

- Policy and Control Management: ServiceNow GRC provides a centralized repository for policies and controls, ensuring version control and easy access for all stakeholders. This feature simplifies policy management and strengthens organizational governance.

- Audit Management and Evidence Collection: The platform simplifies audit management by automating evidence collection and streamlining the audit process. This reduces the time and resources required for audits and improves overall audit efficiency.

- Third-Party Risk Management: ServiceNow GRC helps organizations manage third-party risks by providing tools for vendor risk assessments and ongoing monitoring. This is particularly crucial for businesses relying on external vendors for critical services.

- Highly Customizable Workflow Automation: The platform’s workflow engine allows businesses to tailor workflows to their specific needs, optimizing GRC processes for maximum efficiency.

- Strong Integration Capabilities: ServiceNow GRC integrates seamlessly with existing systems, minimizing disruption and maximizing the value of existing IT investments.

Pros:

- Highly customizable workflow automation adapts to specific organizational needs.

- Strong integration capabilities streamline data flow and minimize disruption.

- Comprehensive audit trails and documentation enhance transparency and accountability.

- Scalable architecture supports growth and evolving compliance requirements, making it suitable for large enterprise environments.

Cons:

- High implementation and licensing costs can be a barrier for smaller organizations. While pricing isn’t publicly available, it typically involves subscription fees based on user counts and modules implemented.

- Configuration requires significant technical expertise, potentially necessitating specialized consultants or internal training.

- The complex user interface can be challenging for non-technical users, requiring dedicated training and ongoing support.

- Implementation can be time-consuming, requiring careful planning and execution.

Implementation and Setup Tips:

- Clearly define your GRC requirements and objectives before starting the implementation process.

- Secure executive sponsorship and involve key stakeholders from across the organization.

- Leverage ServiceNow’s professional services or certified partners for implementation support.

- Develop a comprehensive training program for end-users to ensure adoption and effective utilization.

Comparison with Similar Tools:

While other compliance automation tools exist, ServiceNow GRC stands out due to its comprehensive feature set, robust workflow engine, and strong integration capabilities. Compared to point solutions, ServiceNow GRC offers a more integrated and holistic approach to GRC management. However, smaller organizations with limited budgets might find alternative solutions more suitable.

Target Audience:

ServiceNow GRC is ideally suited for enterprise IT departments, business decision-makers and CTOs in larger organizations operating in regulated industries. It’s also relevant for cloud architects and developers, DevOps and infrastructure teams who are responsible for maintaining security and compliance in cloud environments. While startups and early-stage companies might find the platform’s cost and complexity prohibitive, Learn more about ServiceNow GRC (Governance, Risk & Compliance) to see how aspects of it may still be relevant. Conducting a cloud security assessment, as detailed in the linked resource, can help identify areas where compliance automation tools like ServiceNow GRC can provide significant benefits.

Conclusion:

ServiceNow GRC is a powerful compliance automation tool that can help organizations streamline GRC processes, reduce risk, and ensure regulatory compliance. While the cost and complexity can be significant, its comprehensive features, robust automation capabilities, and scalability make it a valuable investment for large enterprises seeking a comprehensive GRC solution. Especially for companies within the IN region, navigating a dynamic regulatory environment, ServiceNow GRC offers a robust solution to manage compliance effectively. By centralizing and automating GRC activities, businesses can achieve better control, improve efficiency, and gain a competitive advantage. Learn more at https://www.servicenow.com/products/governance-risk-compliance.html.

3. RSA Archer

RSA Archer is a prominent player in the compliance automation tools landscape, offering a robust integrated risk management platform. It’s particularly well-suited for larger enterprises seeking a comprehensive solution to manage governance, risk, and compliance (GRC) across their organization. With a suite of pre-built applications and customizable workflows, RSA Archer helps businesses streamline compliance processes, reduce manual effort, and gain better visibility into their risk posture. This makes it a valuable tool for organizations operating in highly regulated industries facing complex compliance requirements. For companies in the IN region navigating the evolving regulatory landscape, RSA Archer can be instrumental in ensuring adherence to both global and local regulations.

One of RSA Archer’s key strengths lies in its extensive library of pre-built compliance frameworks. These frameworks, covering regulations like SOX, PCI DSS, GDPR, and others relevant to the IN region, provide a solid foundation for building your compliance program. They incorporate industry best practices and regulatory requirements, allowing you to quickly adapt to new regulations and avoid costly penalties. For instance, if your organization handles sensitive customer data, RSA Archer’s pre-built GDPR framework can help automate data subject requests, manage data breaches, and ensure compliance with data privacy regulations.

Beyond pre-built frameworks, RSA Archer provides tools for business continuity and operational risk management, incident management and response, and vendor and third-party risk assessment. This integrated approach enables a holistic view of risk, allowing businesses to identify potential vulnerabilities and implement appropriate controls. For example, DevOps and infrastructure teams can leverage RSA Archer to manage security risks related to cloud deployments, while business decision-makers can use it to assess the impact of operational risks on business objectives. This comprehensive coverage is especially important for startups and early-stage companies in the IN region seeking to establish robust risk management practices from the outset.

RSA Archer’s strong analytical and reporting capabilities empower businesses to monitor compliance performance, track key risk indicators, and generate customized reports. Real-time dashboards provide a clear overview of compliance status, enabling proactive risk mitigation. These analytics can be invaluable for enterprise IT departments in the IN region, offering insights into security vulnerabilities and compliance gaps. Cloud architects and developers can also leverage these features to track compliance of their cloud infrastructure and ensure adherence to security best practices.

While RSA Archer offers substantial benefits, it’s important to consider its drawbacks. Implementing the platform can be complex and often requires specialized expertise. The total cost of ownership can be high, potentially posing a challenge for startups and early-stage companies with limited budgets. The user interface, although functional, might feel dated compared to some modern alternatives, requiring significant training for effective use.

Unfortunately, specific pricing and technical requirements for RSA Archer aren’t publicly available. Potential users need to contact RSA directly for detailed information and tailored quotes. Compared to some more user-friendly, cloud-based compliance automation tools, RSA Archer’s complexity and cost might be more suitable for larger enterprises with dedicated resources.

For organizations considering RSA Archer, several implementation tips can help ensure a smooth rollout: Begin with a clearly defined scope and prioritize key compliance requirements. Leverage RSA Archer’s pre-built frameworks as a starting point and customize them to fit your specific needs. Invest in adequate training for your team to maximize the platform’s potential. Consider partnering with an experienced implementation partner to navigate the complexities of the platform and ensure a successful deployment.

Despite its complexity and cost, RSA Archer’s comprehensive features, mature platform, and strong analytical capabilities make it a compelling option for enterprise-level compliance automation. It’s a valuable tool for businesses in the IN region looking for a robust solution to manage complex regulatory requirements and strengthen their overall risk management posture. You can explore more details on their website: https://www.rsa.com/en-us/products/integrated-risk-management

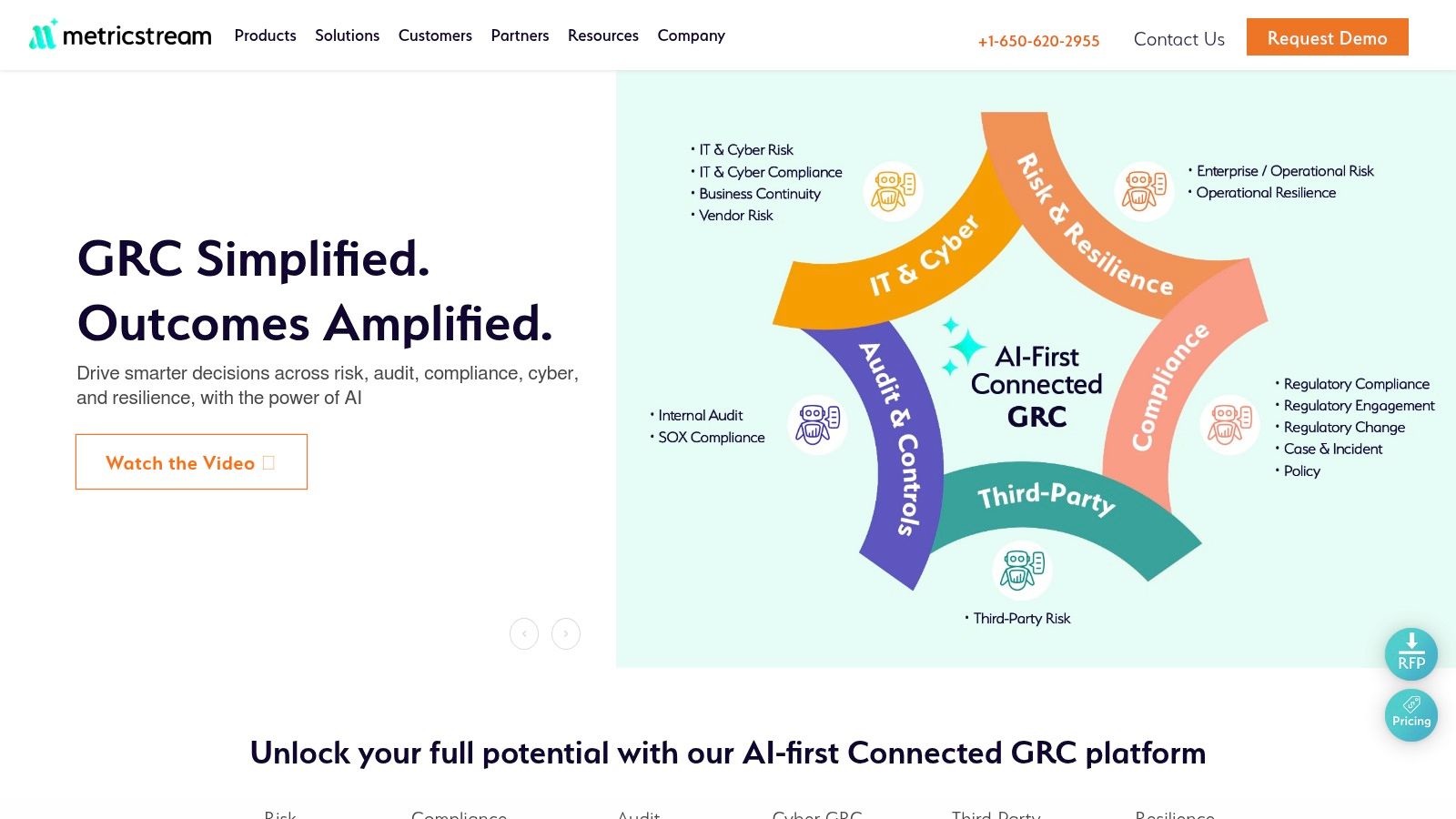

4. MetricStream

MetricStream offers a robust and comprehensive governance, risk, and compliance (GRC) platform that goes beyond basic compliance automation. It provides AI-powered solutions designed to streamline compliance processes, manage risk effectively, and integrate seamlessly with existing business operations. This makes it a powerful tool for organizations looking to move beyond manual compliance checks and embrace a more proactive, data-driven approach. This comprehensive approach is particularly relevant for businesses operating in heavily regulated industries or those seeking to establish a strong GRC framework. While its robust features might be more suited to larger enterprises, its value proposition as a single source of truth for all GRC activities makes it worthy of consideration for businesses of all sizes aspiring for mature compliance practices.

MetricStream distinguishes itself among compliance automation tools through its focus on integrating risk management with core business processes. This integrated approach facilitates continuous compliance monitoring, allowing organizations to identify and address potential issues in real-time rather than reacting to them after the fact. This proactive approach minimizes disruptions, reduces the likelihood of penalties, and fosters a culture of compliance throughout the organization.

For Indian businesses, navigating the complex and ever-evolving regulatory landscape can be particularly challenging. MetricStream offers industry-specific compliance applications tailored to various sectors, including BFSI, healthcare, and manufacturing. These pre-built applications provide a significant advantage, offering pre-configured controls, workflows, and reporting templates specific to Indian regulations. This reduces the burden of manual configuration and ensures businesses remain compliant with local laws and industry best practices.

Key features of MetricStream that contribute to its effectiveness as a compliance automation tool include:

- AI-powered Risk and Compliance Analytics: MetricStream leverages AI and machine learning to identify emerging risks, predict potential compliance breaches, and provide data-driven insights for proactive risk mitigation.

- Industry-Specific Compliance Applications: The platform provides tailored solutions for specific sectors, including those relevant to the IN region, ensuring compliance with local regulations.

- Automated Control Testing and Monitoring: MetricStream automates the testing and monitoring of controls, ensuring continuous compliance and significantly reducing the manual effort involved in traditional compliance processes.

- Regulatory Change Management: The platform tracks regulatory changes globally, providing timely updates and helping organizations adapt to new requirements efficiently.

- Integrated Audit and Assessment Workflows: MetricStream streamlines audit and assessment processes, enabling seamless collaboration and efficient reporting.

Pros:

- Strong AI and machine learning capabilities: Provides advanced analytics for proactive risk management.

- Industry-specific solutions and expertise: Offers tailored solutions for various sectors in India.

- Comprehensive regulatory content library: Keeps organizations up-to-date with the latest regulatory changes.

- Good mobile accessibility and user experience: Facilitates access and usability across various devices.

Cons:

- Premium pricing for advanced AI features: The full suite of features can be expensive, especially for smaller organizations.

- Can be overwhelming for smaller organizations: The platform’s comprehensive nature might be more than what some smaller businesses require.

- Implementation complexity for full feature utilization: Realizing the full potential of MetricStream requires careful planning and execution during implementation.

- Limited integration options compared to some competitors: While integrations exist, they may not be as extensive as some other platforms.

Implementation Tips:

- Start with a clear understanding of your organization’s specific compliance requirements.

- Prioritize the features and modules that will deliver the most significant value initially.

- Leverage MetricStream’s professional services or certified partners for implementation support.

- Develop a comprehensive training program for users to ensure effective adoption.

While pricing information is not publicly available, it’s understood that MetricStream follows a subscription-based model, with pricing tiers based on the number of users, modules, and features required. Technical requirements vary depending on the deployment model (cloud or on-premise). Interested organizations should contact MetricStream directly for detailed pricing and technical specifications relevant to their needs.

Compared to tools like ServiceNow GRC or LogicManager, MetricStream emphasizes the integration of GRC with business operations, offering a more holistic approach to risk and compliance management. This makes it a strong contender for organizations looking for a comprehensive GRC platform rather than just a point solution for compliance automation. For more information, visit the MetricStream website: https://www.metricstream.com

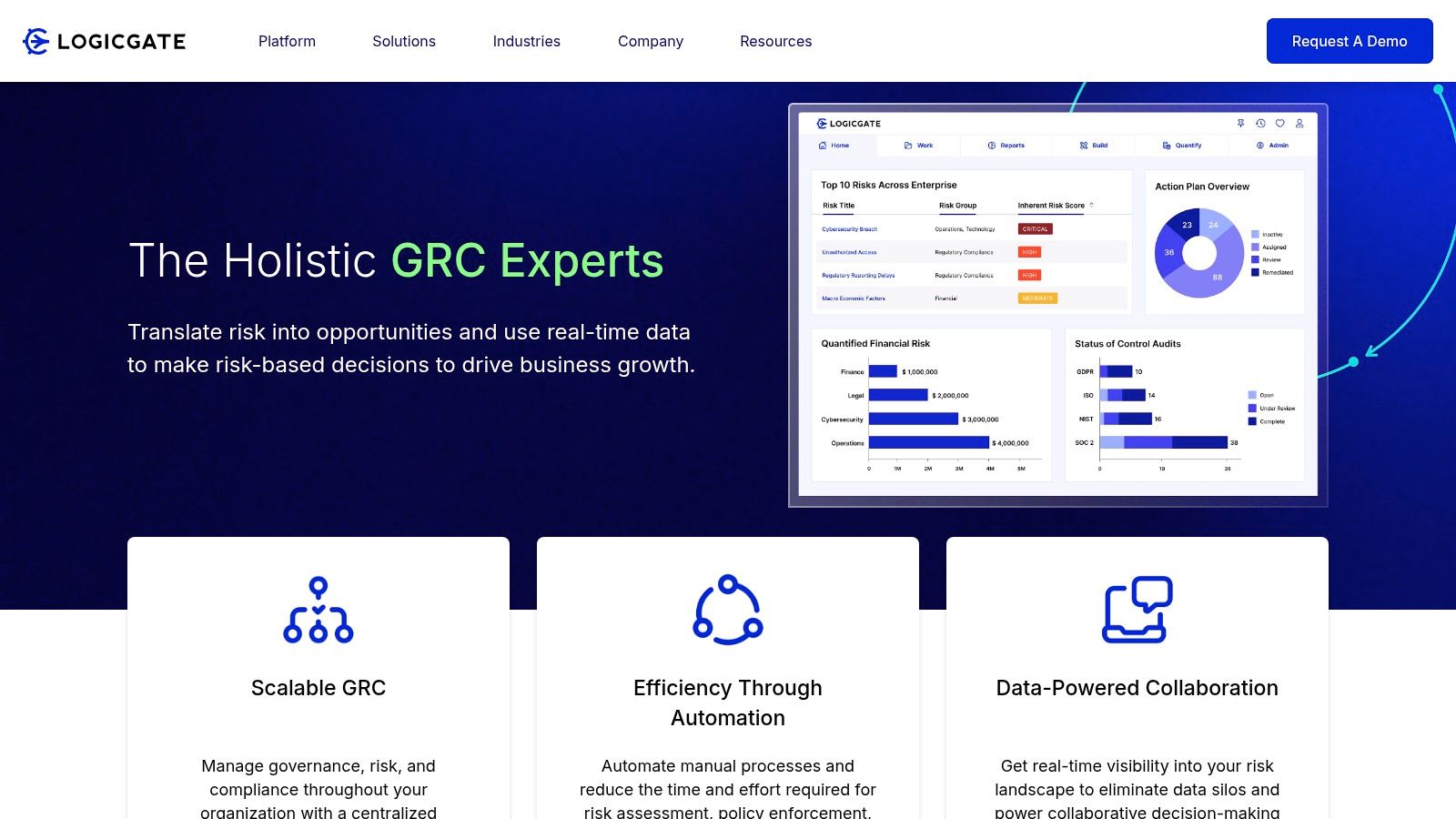

5. LogicGate Risk Cloud

LogicGate Risk Cloud earns its spot on this list of top compliance automation tools due to its flexible, no-code platform specifically designed for modern enterprises. In today’s rapidly evolving regulatory landscape, businesses in IN, from startups to large enterprises, face the challenge of managing increasingly complex compliance requirements. LogicGate addresses this challenge by empowering organizations to build custom compliance workflows and automate risk management processes, all without needing specialized technical expertise. This makes it a powerful tool for compliance professionals, IT departments, and business decision-makers alike, enabling them to streamline operations and reduce risk.

LogicGate’s no-code workflow builder is a standout feature, allowing users to visually design and automate compliance processes, from policy management and incident response to regulatory reporting. This drag-and-drop interface simplifies complex tasks, enabling faster implementation and adaptation to changing regulations. Automated risk assessments and monitoring further enhance compliance efforts by proactively identifying potential vulnerabilities and providing real-time insights into the organization’s risk profile. This is particularly valuable for startups and early-stage companies in IN looking to establish robust compliance practices early on.

For enterprise IT departments and cloud architects in IN dealing with intricate infrastructure and security requirements, LogicGate offers customizable compliance frameworks and controls. This allows organizations to tailor the platform to their specific industry, regulatory obligations, and internal policies. Integrating with existing systems, including GRC platforms and other business applications, enhances data centralization and streamlines reporting. Real-time reporting and analytics dashboards provide a comprehensive view of compliance performance, empowering business decision-makers and CTOs with the information they need to make informed decisions.

While LogicGate offers a compelling suite of features, it’s essential to consider its limitations. Compared to more established players in the market, LogicGate has a relatively smaller market presence and may lack some of the advanced features required for extremely complex enterprise needs. The library of pre-built compliance frameworks, while growing, is still limited, which may necessitate more customization effort for certain industries and regulations. Furthermore, while the platform is designed for ease of use, maximizing its potential may require leveraging the available customer support and training resources.

Pricing for LogicGate Risk Cloud is typically subscription-based and scales with the number of users and modules required. While the initial setup can be relatively quick and cost-effective, adding more advanced functionalities can increase the overall cost. It is advisable to contact LogicGate directly for detailed pricing information tailored to specific organizational needs. There are no publicly available specific technical requirements, but as a cloud-based platform, a stable internet connection and modern browser are necessary.

Compared to similar tools like ServiceNow GRC and MetricStream, LogicGate distinguishes itself through its user-friendly, no-code approach, making it particularly attractive to organizations with limited technical resources. While ServiceNow and MetricStream offer more comprehensive pre-built content, LogicGate’s flexibility and customization capabilities provide a distinct advantage for organizations needing to tailor their compliance programs to specific requirements.

For organizations in IN considering implementing LogicGate Risk Cloud, here are a few tips:

- Start with a clear understanding of your compliance requirements: Identify the specific regulations and policies you need to address. This will help you effectively configure the platform and maximize its benefits.

- Leverage the available training and support resources: LogicGate offers comprehensive training and support to help users get up to speed quickly and effectively utilize the platform’s features.

- Start small and scale gradually: Begin by implementing the platform for a specific compliance area or process and gradually expand its use as your team becomes more familiar with the system.

- Integrate with existing systems: Connect LogicGate with your existing GRC platforms and other business applications to streamline data flow and reporting.

By carefully considering these factors and leveraging LogicGate’s strengths, organizations in IN can effectively automate their compliance processes, reduce risk, and navigate the complexities of the modern regulatory environment. You can explore more about LogicGate Risk Cloud by visiting their website: https://www.logicgate.com

6. IBM OpenPages

IBM OpenPages is a robust enterprise governance, risk, and compliance (GRC) platform offering comprehensive compliance automation tools for organizations of all sizes, though it’s particularly well-suited for larger enterprises. It provides integrated risk management, regulatory compliance tracking, and business continuity planning, all enhanced by advanced analytics and AI-powered insights. This makes it a powerful solution for organizations seeking to streamline their compliance processes and gain a deeper understanding of their risk landscape. For companies operating in the IN region, facing increasingly complex regulatory requirements, a tool like OpenPages can be invaluable in maintaining compliance and minimizing potential penalties.

OpenPages stands out among compliance automation tools due to its sophisticated features and enterprise-grade capabilities. Its integrated GRC approach allows businesses to manage all aspects of governance, risk, and compliance from a single platform. This integrated approach breaks down silos between departments, improves data visibility, and enables more effective decision-making. Its AI-powered analytics capabilities are particularly noteworthy, providing predictive insights that help organizations proactively identify and mitigate potential risks. This is especially relevant in sectors like finance and healthcare, which are subject to stringent regulatory scrutiny within the IN region.

Key features of IBM OpenPages include integrated GRC with AI-powered analytics, model risk management and validation, regulatory compliance and change management, business continuity and operational resilience, and advanced reporting and visualization tools. The platform’s model risk management capabilities are particularly valuable for financial institutions, enabling them to validate and monitor their risk models effectively. Furthermore, its regulatory compliance and change management features help organizations adapt to evolving regulatory landscapes, ensuring ongoing compliance. In the context of dynamic markets and evolving regulations within the IN region, these features become crucial for maintaining a proactive compliance posture.

Pros:

- Strong AI and cognitive computing capabilities: OpenPages leverages AI to provide predictive risk insights, enabling proactive risk management.

- Comprehensive enterprise-grade features: It offers a full suite of GRC capabilities, covering risk management, compliance, and business continuity.

- Excellent scalability for large organizations: OpenPages can handle the complex needs of large enterprises with extensive data and intricate compliance requirements.

- Robust security and data protection measures: It provides robust security features to protect sensitive data and ensure compliance with data privacy regulations.

Cons:

- High cost and complex licensing structure: OpenPages can be expensive, particularly for smaller organizations, and its licensing structure can be complex to navigate.

- Requires significant technical resources for implementation: Implementing OpenPages typically requires specialized technical expertise and can be a time-consuming process.

- Steep learning curve for end users: The platform’s advanced features can be challenging for some users to master, requiring substantial training.

- Can be over-engineered for mid-market companies: While scalable, the extensive feature set might be excessive for mid-market companies, potentially leading to unnecessary complexity and cost.

While information regarding specific pricing and technical requirements for IBM OpenPages is not readily available, potential users are encouraged to contact IBM directly for a personalized quote and consultation. This personalized approach is important for tailoring the implementation to specific organizational needs, particularly within the diverse business landscape of the IN region. Learn more about IBM OpenPages to gain a more in-depth understanding of its technical aspects and integrations.

For startups and early-stage companies, the cost and complexity of IBM OpenPages might be prohibitive. However, for enterprise IT departments, cloud architects, developers, DevOps and infrastructure teams, and business decision-makers in larger organizations, particularly those operating within heavily regulated industries in the IN region, OpenPages provides a powerful solution for automating compliance processes and managing risk effectively. Implementing OpenPages requires careful planning and dedicated resources. It’s advisable to engage with IBM’s professional services or certified partners to ensure a smooth implementation process. Consider conducting a thorough needs assessment to determine if OpenPages aligns with your specific requirements and resources. Compare it with other compliance automation tools to identify the best fit for your organization’s size, industry, and specific compliance needs. This detailed analysis will help ensure that the chosen tool provides the necessary functionality while remaining manageable within the organization’s technical capabilities and budget.

7. OneTrust

OneTrust stands out as a leading compliance automation tool, specifically designed for organizations prioritizing data privacy and protection in today’s increasingly regulated digital landscape. It offers a comprehensive suite of features catering to various compliance needs, making it a valuable asset for businesses of all sizes, particularly those operating within the IN region and subject to international regulations like GDPR and CCPA. OneTrust allows companies to streamline their compliance processes, reduce risks, and build trust with customers by demonstrating a commitment to data security. This is crucial for maintaining a positive brand reputation and avoiding potential legal repercussions.

OneTrust excels in its privacy compliance automation capabilities, offering modules specifically designed for GDPR, CCPA, LGPD (Brazil’s General Data Protection Law), and other emerging privacy regulations. These modules provide automated workflows for data subject requests, consent management, and data breach notifications, significantly reducing the manual effort required for compliance. This robust focus on privacy makes OneTrust particularly relevant for organizations handling sensitive personal data, especially in industries like healthcare, finance, and e-commerce. For businesses in the IN region dealing with international data transfers and varying data protection standards, OneTrust provides a centralized platform to manage these complex requirements effectively.

Beyond privacy, OneTrust extends its functionalities to encompass broader compliance management features, including vendor risk management and ethics reporting. The vendor risk management module enables businesses to assess and monitor the security posture of their third-party vendors, ensuring they also comply with relevant regulations. This is particularly important for organizations relying on cloud service providers and other external partners. The ethics and compliance hotline management feature provides a secure channel for employees and stakeholders to report potential violations, fostering a culture of compliance and transparency.

For organizations operating within the IN region and keen on implementing best practices for data protection in the cloud, exploring resources like Learn more about OneTrust can be beneficial. Understanding cloud security measures can significantly bolster your overall compliance strategy.

Features:

- Privacy Compliance Automation: Streamlines compliance with GDPR, CCPA, LGPD, and other privacy regulations.

- Data Mapping and Inventory Management: Facilitates the identification and classification of sensitive data across the organization.

- Consent and Preference Management: Provides tools for managing user consent and preferences regarding data collection and usage.

- Vendor and Third-Party Risk Assessment: Automates the process of assessing and mitigating risks associated with third-party vendors.

- Ethics and Compliance Hotline Management: Offers a secure platform for reporting and managing ethics and compliance concerns.

Pros:

- Leading solution for privacy compliance.

- User-friendly interface and implementation.

- Strong focus on data protection regulations.

- Comprehensive vendor risk management features.

Cons:

- Primarily focused on privacy, with limited broader GRC features.

- Can be expensive for smaller organizations.

- Some advanced features require additional modules.

- Limited customization compared to broader GRC platforms.

While pricing information for OneTrust isn’t publicly available, it generally operates on a subscription-based model, with pricing tiered based on the number of modules and users. Technical requirements are minimal, as OneTrust is a cloud-based platform accessible through a web browser. Implementation typically involves onboarding and configuration based on the specific needs of the organization.

Compared to broader Governance, Risk, and Compliance (GRC) platforms, OneTrust’s strength lies in its specialized focus on privacy compliance automation. While GRC platforms offer a wider range of functionalities, OneTrust provides a more in-depth and tailored solution for organizations prioritizing data protection.

For implementing OneTrust, begin by clearly defining your compliance requirements and selecting the relevant modules. Engage with OneTrust’s implementation team for assistance with configuration and data migration. Ongoing training and support are essential to maximize the platform’s effectiveness and maintain compliance in the evolving regulatory landscape. OneTrust deserves its place on this list because it provides a robust and specialized solution for organizations looking to automate their privacy compliance programs, especially crucial in the IN region where businesses must navigate a complex web of international data protection laws. The platform’s user-friendly interface and comprehensive features empower organizations to effectively manage their data privacy risks and build trust with their customers.

8. Resolver

Resolver is a powerful compliance automation tool that distinguishes itself through its comprehensive risk intelligence platform. Unlike some tools that focus solely on specific regulations, Resolver provides a holistic approach to risk management, incorporating incident management, risk assessment, and business continuity planning. This integrated approach makes it an excellent choice for organizations looking to build operational resilience and strengthen their overall risk posture. Its focus on industry-specific solutions also makes it highly relevant for regulated industries such as healthcare and financial services, which face unique compliance challenges. For businesses in IN seeking a robust solution for compliance automation, Resolver offers a worthwhile platform to explore.

Resolver’s integrated incident and case management feature streamlines the entire lifecycle of responding to compliance incidents. From initial reporting and investigation to resolution and documentation, Resolver provides a centralized platform for managing all aspects of incident response. This not only helps ensure compliance with regulatory requirements but also facilitates continuous improvement by identifying trends and patterns in incidents. Automated compliance monitoring and reporting features further enhance the platform by providing real-time insights into compliance status. This allows organizations to proactively identify potential violations and take corrective action before they escalate into major issues. For startups and early-stage companies in IN, this feature can be especially valuable as it allows them to build a strong compliance foundation from the outset.

For enterprise IT departments, cloud architects, and DevOps teams, Resolver’s integration with security and IT systems provides a seamless experience. This integration enables automated workflows and data sharing, reducing manual effort and improving overall security posture. The platform’s business continuity and crisis management features are essential for ensuring business operations can continue even in the face of disruptions. This capability is particularly relevant in today’s uncertain environment and provides peace of mind for business decision-makers and CTOs. Resolver also addresses vendor and supply chain risk management, a critical aspect of compliance for many organizations. By assessing and mitigating risks associated with third-party vendors, Resolver helps organizations protect themselves from potential compliance breaches and reputational damage.

Resolver’s industry-specific solutions are a major advantage, particularly for heavily regulated sectors like healthcare and financial services. These solutions are tailored to the unique compliance requirements of each industry, providing organizations with a pre-built framework for managing complex regulations. For example, healthcare organizations in IN can leverage Resolver’s solutions to comply with HIPAA and other relevant regulations. Financial services companies can benefit from solutions designed to address KYC/AML, GDPR, and other financial regulations.

While Resolver offers numerous benefits, potential users should be aware of some considerations. Achieving comprehensive coverage may require subscribing to multiple modules, which can add to the overall cost. The pricing structure for these modules can be complex, and it’s important to understand the costs associated with each module before committing to a purchase. While Resolver integrates well with existing systems, the user interface could be more modern and intuitive. Some users may find the interface less user-friendly compared to other tools on the market. Finally, while Resolver provides robust reporting capabilities, its advanced analytics features are less developed than some competitors. Organizations requiring sophisticated data analysis and predictive modeling may need to consider supplementary tools.

Information regarding specific technical requirements and detailed pricing is not readily available on the public website. Potential users are encouraged to contact Resolver directly to discuss their specific needs and obtain a tailored quote. Implementation tips include engaging with Resolver’s professional services team to ensure a smooth onboarding process and maximizing the value of the platform. This is especially recommended for larger enterprises and organizations with complex compliance requirements.

In comparison to similar tools like LogicManager and MetricStream, Resolver stands out with its strong focus on operational resilience and incident management. While other tools may offer broader GRC capabilities, Resolver excels at providing a practical, integrated approach to managing risk and ensuring compliance. For organizations in IN prioritizing operational continuity and incident response, Resolver offers a compelling solution. Visit their website at https://www.resolver.com for more information.

Compliance Automation Tools Comparison

| Platform | Core Features & Highlights | User Experience & Quality | Value & Pricing | Target Audience | Unique Selling Points |

|---|---|---|---|---|---|

| Microsoft 365 Compliance Center | DLP, compliance score, eDiscovery, governance | Seamless MS integration, steep learning curve | Moderate-high; requires E3/E5 licenses | Enterprises in Microsoft ecosystem | Real-time scoring, extensive data classification |

| ServiceNow GRC | Automated compliance, risk workflows, audit management | Customizable, complex UI, technical setup | High; costly licensing & implementation | Large enterprises needing workflow automation | Strong workflow automation, audit trail |

| RSA Archer | Pre-built compliance frameworks, incident & vendor risk mgmt | Mature platform, UI outdated, training needed | High total cost of ownership | Large enterprises with complex risk needs | Extensive framework library, analytics |

| MetricStream | AI-powered analytics, industry-specific apps, regulatory mgmt | Good UX/mobile, complex implementation | Premium pricing, complex for SMBs | Regulated industries seeking AI insights | AI & ML capabilities, broad regulatory content |

| LogicGate Risk Cloud | No-code workflow builder, risk assessments, real-time reporting | User-friendly, quick setup, limited frameworks | Moderate; can escalate with modules | Compliance pros needing low-code customization | No-code platform, fast implementation |

| IBM OpenPages | AI-powered GRC, risk & compliance, business continuity | Scalable, complex, steep learning curve | High cost, complex licensing | Large enterprises, AI-focused risk management | AI & cognitive computing, enterprise-grade |

| OneTrust | Privacy compliance, data mapping, consent mgmt | User-friendly, privacy focused | Moderate-high; extra modules pricey | Privacy officers, data protection-focused firms | Leading privacy platform, vendor risk management |

| Resolver | Incident & case mgmt, compliance monitoring, vendor risk | Good industry focus, UI less modern | Complex pricing, multiple modules | Regulated industries needing operational resilience | Strong incident mgmt, business continuity |

Choosing the Right Compliance Automation Tools for Your Business

Selecting the right compliance automation tools is crucial for navigating the increasingly complex regulatory landscape. This article explored a range of leading solutions, from established platforms like Microsoft 365 Compliance Center, ServiceNow GRC, RSA Archer, MetricStream, LogicGate Risk Cloud, IBM OpenPages, OneTrust, and Resolver, each offering unique strengths and capabilities. The key takeaway is that there’s no one-size-fits-all solution. Your choice depends heavily on your specific industry regulations, budget constraints, existing IT infrastructure, and the technical expertise available within your organization.

Implementing compliance automation tools requires careful planning. Consider factors like integration with existing systems, scalability to accommodate future growth, and the level of customization needed to meet your specific compliance requirements. Startups and early-stage companies, as well as larger enterprise IT departments, cloud architects, developers, DevOps teams, and business decision-makers, all benefit from the efficiency and risk mitigation that these tools provide. By automating manual processes, you free up valuable resources, reduce human error, and gain a more comprehensive view of your compliance posture. This, in turn, empowers you to make more informed decisions and focus on strategic initiatives.

For organizations operating within the IN region, staying compliant with local regulations is paramount. Choosing the correct compliance automation tools helps ensure adherence and avoids potential penalties. Embrace automation as a strategic advantage, enabling your business to not simply survive, but thrive in a competitive market.

Looking for a comprehensive approach to cloud security and DevOps compliance in the cloud? Signiance Technologies offers a suite of cloud-based solutions, including automated compliance assessments, to streamline your compliance journey. Visit Signiance Technologies to learn more and build a secure and compliant cloud infrastructure.